Home Buyer Starter Kit

Everything you need to know when buying a home.

Loan Officer

NMLS ID: 1591

Phone: 123-456-7890

Email: loan.officer@churchillmortgage.com

Start Your Pre-Approval

NMLS ID: 1591

Phone: 123-456-7890

Email: loan.officer@churchillmortgage.com

Request a Call Back

Read My ReviewsStart Your Pre-Approval

Most first-time buyers stop before they even start. And it’s no surprise — the housing market is full of negative headlines, mixed advice, and overwhelming data.

But the fact you’re here already puts you ahead. You’re taking the time to prepare and learn, which means you’ll step into this process with more confidence than most.

That’s why we created this guide. We’ll walk with you through the home buying process, step by step with tips you can actually use. By the end, you’ll not only feel prepared — you’ll be able to explain it to friends and family who are thinking about buying, too.

In this guide, you'll learn:

Behind every home purchase is a team of people working to make it happen. Here are the key players you’ll meet:

Your Home Loan Specialist will be your main point of contact during the loan process. They’ll explain loan options, help you gather documents, and answer questions along the way. No extra cost to you — this service is built into working with your lender.

A mortgage lender is the company providing your loan (like us, Churchill Mortgage). They review your finances, underwrite the loan, and approve the final amount. Lender fees vary but are disclosed up front in your Loan Estimate.

A real estate agent helps you search for homes, make offers, and negotiate with sellers. In most cases, the seller covers the agent’s commission — so there’s no out-of-pocket cost for you as the buyer.

The insurance agent finds a homeowners insurance policy that protects your home and belongings. Premiums depend on location, home size, and coverage options. Expect to budget around $100–$200 per month.

The title and escrow officers confirm legal ownership of the home, hold funds in escrow, and manage the closing paperwork. Title insurance and escrow fees vary but usually run 0.5–1% of the home’s purchase price. (Don’t worry, we’ll cover escrow later!)

Your home inspector evaluates the home for hidden issues (like roof damage, plumbing problems, or safety concerns). Inspections are optional but highly recommended. Pricing varies by location, usually $300–$600.

A home appraiser determines the fair market value of the property, which ensures you’re not overpaying. An appraisal is required by lenders. Costs are typically $500–$700 and are included in your closing costs.

You’ve got a sense of the team that will help you through this process — now let’s talk about where it all begins. Before you even start house hunting, you’ll want to know how much home you can really afford.

That’s where pre-qualification and pre-approval come in. They might sound similar, but they play very different roles in the home buying process. Knowing the difference will save you time, stress, and give you an edge when you’re ready to make an offer.

Are you ready to start? Excellent!

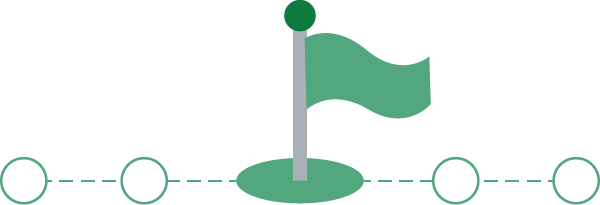

Everyone thinking about buying a home should start in the same place: Getting Pre-Approved. A quick phone call to your local Home Loan Specialist is all it takes to get things moving.

Complete a Loan Application

Get Pre-Qualified for a ballpark loan amount

Provide Financial Documentation

Get Pre-Approved for a specific amount

Hire A Real Estate Agent

Sign a Sales Contract for the Property

Sign Your Loan Disclosures within 24 hours

Attend the Home Inspection or Review Report

Churchill Mortgage Orders the Appraisal

Your loan is approved and you sign the closing disclosure*

Sign Loan Documents and Close on Your Loan

Get Your Keys and Celebrate

* An appraisal normally takes up to two weeks from the time it is ordered until the report is received. *You are required to sign the closing disclosure by midnight of the same day it is issued.

Start Your Pre-Approval

The first big question on your mind right now is probably: “How much house can I actually afford?” Before you start looking at listings or walking through open houses, it helps to understand how lenders look at your finances and decide what you qualify for.

In this chapter, we’ll walk through the first steps — from pre-approval to breaking down a monthly payment — and explain how credit scores, interest rates, and debt-to-income ratio all play a role. Think of it as the “know before you go” part of buying a home. Once you have this down, you’ll feel more confident moving forward and avoid surprises later.

Before you start house hunting, you’ll want a clear idea of what you can afford. That’s where pre-qualification and pre-approval come in. They sound similar, but they’re two very different steps.

Think of pre-qualification as a quick estimate. You share some basic details — like your income, debts, and credit score range — and the lender gives you a ballpark idea of how much you might be able to borrow. No documents are verified, and usually no credit pull is involved. It’s helpful if you’re just starting out and want to see whether you should be looking at $250,000 homes or $350,000 homes.

Pre-approval goes deeper. You complete a mortgage application, provide documents (like pay stubs and bank statements), and the lender pulls your credit. Once everything checks out, they issue a pre-approval letter with the loan amount you actually qualify for and what your monthly payment might look like.

This letter makes a big difference. Sellers and agents see it as proof you’re serious and financially ready, and it gives you peace of mind knowing your budget is realistic. In a competitive market, pre-approval can be the thing that puts your offer ahead of others.

| Benefits | Pre-Qualification | Pre-Approval |

|---|---|---|

| Quick, informal estimate | ✔️ | ❌ |

| Based on self-reported information | ✔️ | ❌ |

| Requires verified documents (pay stubs, bank statements, credit report) | ❌ | ✔️ |

| Gives you a rough idea of monthly payment | ✔️ | ❌ |

| Locks in a realistic, trusted payment range | ❌ | ✔️ |

| Sellers rely on it when reviewing offers | ❌ | ✔️ |

Pre-qualification is a good starting point when you’re just exploring, but pre-approval is what sets you up for success when you’re ready to make an offer. One is a ballpark estimate, the other is a verified commitment — and only pre-approval gives you true confidence in your budget.

Your Turn!

Use our Monthly Mortgage Calculator below to test different loan amounts, down payments, and interest rates to see how they change your monthly payment.

Your monthly mortgage payment can be calculated from three numbers: your interest rate, the loan term, and the price of the property.

What is your down payment? Generally between 3% to 20% of the purchase price, your down payment is subtracted from the purchase price to calculate your final loan amount.*

*Other factors can effect your final loan amount.

What about taxes and insurance?

Look up your local tax rate and estimate your annual insurance cost, then add them in to get a more accurate picture of your monthly payment.

Confused? Have Questions?

Call us and chat with a Churchill Home Loan Specialist to get answers today.

This calculator is being provided for educational purposes only. The provided values for interest rates are examples only and do not reflect Churchill Mortgage Product terms & offers. The results are estimates that do not include expenses like taxes and insurance, and are based on information you provided and may not reflect Churchill Mortgage Product terms. The information cannot be used by Churchill Mortgage to determine a customer's eligibility for a specific product or service.

These calculations are hypothetical examples designed to for illustration purposes only. Consult a Home Loan Specialist for more specific information regarding payments, terms, etc.

Getting pre-approved is more formal than pre-qualification, but it doesn’t have to be complicated. Here’s what to expect:

You’ll start by completing a mortgage application — either online, over the phone, or in person with one of our Home Loan Specialists. As part of the process, your lender will pull your credit report and review your financial information to verify your income, assets, debts, and overall credit history.

Once everything checks out, you’ll receive a pre-approval letter. This letter spells out exactly how much you’re approved to borrow and gives sellers confidence that you’re a serious buyer with financing already underway. In a competitive market, that letter can make your offer stand out.

To keep the process smooth, you’ll need to provide a few documents that verify your finances. We’ve pulled together a simple Document Checklist (see below) so you know exactly what to gather before you start. The more prepared you are, the faster you’ll get your pre-approval letter in hand.

Gone are the days of digging through file cabinets or mailing stacks of forms. With Churchill, everything is handled in one place. Our secure MyChurchill platform makes it easy to upload your documents, track what’s been submitted, and keep the process moving smoothly. If we need anything additional, we’ll let you know right away.

What to Send: A clear, color copy or photo (front and back) of a valid government-issued photo ID.

Accepted Formats: JPEG, PNG, or PDF

Why we need it: To confirm your identity and keep your loan secure. It’s just like showing your ID at the airport — it keeps everything safe and official.p>

What to Send: Your most recent paystubs showing your name, employer, pay dates, and year-to-date earnings.

Accepted Formats: PDF download from your payroll system, or a clear photo/scan.

Why we need it: To verify your current income and make sure your monthly mortgage payment will be comfortable for your budget.

What to Send: Complete copies of your W-2s from each employer over the past two years.

Accepted Formats: PDF copies from your tax records or scanned paper forms.

Why We Need It: To show your income history and stability over time, which helps us know what kind of loan you can safely afford.

What to Send: Full monthly statements (not screenshots) showing your name, account number, balances, and all pages (even the blank ones).

Accepted Formats: Official PDF downloads from your bank.

Why We Need It: To confirm you have enough funds for your down payment, closing costs, and a little cushion for your first pizza night in your new home.

What to Send: A clear photo or scan of your Social Security card -or- a clear copy of your current, valid permanent resident card or other proof of legal residence.

Accepted Formats: JPEG, PNG, or PDF.

Why We Need It:To verify your identity & eligibilty, and connect your loan application with your credit and tax records.

What to Send: A fully signed purchase agreement showing all pages and signatures, plus a copy of the cleared earnest money check or receipt.

Accepted Formats: PDF is best.

Why We Need It: To lock in the details of the home you’re buying and confirm you’ve made a good faith deposit.

What to Send: A fully signed sales contract for the home you’re selling.

Accepted Formats: PDF copy of the entire agreement.

Why We Need It: To see the equity you’ll receive from the sale, which can help with your down payment or closing costs.

What to Send:Last 2 years of complete personal federal tax returns (all pages and schedules).

Accepted Formats:PDFs only, directly from your tax software or scanned copies.

Why We Need It:To confirm your income when you don’t have paystubs or W-2s, and to show your business is active and stable.

What to Send: Last 2 years of complete business federal tax returns (all pages and schedules).

Accepted Formats: PDFs only, directly from your tax software or scanned copies.

Why We Need It: To confirm your income when you don’t have paystubs or W-2s, and to show your business is active and stable.

What to Send: A copy of your current business license or professional license.

Accepted Formats: PDFs only, directly from your tax software or scanned copies.

Why We Need It: To confirm your income when you don’t have paystubs or W-2s, and to show your business is active and stable.

What to Send: Your most recent quarterly statement for each account showing your name, account number, and current balance.

Accepted Formats: PDF downloads from your account portal

Why We Need It: These extra funds aren’t required, but they show your financial strength and can help your loan approval.

No Paperwork Headaches

When you apply for pre-approval, your lender will check your credit report. This step is important because it verifies your history of borrowing and repayment, which helps confirm what you can realistically afford.

Don’t stress the hard pull. A few points on your score won’t make or break your ability to buy a home — but having that pre-approval letter can make all the difference when it comes to getting your offer accepted.

When you get a hard credit pull for a mortgage, you have about 90 days to shop around with other lenders without needing another pull. That means you can compare options and rates during that window without worrying about multiple hits to your credit.

Start Your Pre-Approval

When most people think about buying a home, they picture the big number — the price on the listing. But what really matters to your budget is the monthly payment, because that’s what you’ll actually live with month after month (just like rent, car payments, or all those streaming subscription fees).

Your monthly mortgage payment isn’t just one simple bill. It’s made up of four parts, often called PITI. Understanding these pieces helps you see the full picture of what you can afford, and keeps you from being surprised later.

Principal: The portion of your payment that goes toward paying down the actual amount you borrowed. Over time, this reduces your loan balance.

Interest: The cost of borrowing money from the lender. Your interest rate determines how much this piece will be.

Taxes: Property taxes are collected by your lender and paid to your local government. The amount depends on where you live and the value of your home.

Insurance: Homeowners insurance protects your home and belongings. If you put down less than 20%, you may also have to pay mortgage insurance, which protects the lender until you build more equity.

Here’s how a typical $350,000 home purchase might look when you break down the monthly payment into principal, interest, taxes, and insurance.

When you borrow a large amount of money to buy a home, you’ll be charged a fee for using that money. That fee is called interest, and it’s expressed as a percentage of your loan amount.

Over time, this percentage adds up, and that’s why your payment is split between principal (paying down what you borrowed) and interest (the lender’s fee).

Lenders aren’t just giving away money — they take on risk every time they approve a loan. Charging interest is how they cover that risk and make it possible to lend in the first place. You can think of it like paying “rent” on the money until you’ve fully paid the loan back.

Your exact interest rate is shaped by two things:

Big-picture forces like inflation, the bond market, and Federal Reserve policy move mortgage rates up and down for everyone.

Dig Deeper: How Bonds and Mortgage-Backed Securities Impact Rates

Most mortgage rates are tied to the bond market, especially the 10-year U.S. Treasury note. Here’s why:

On top of that, mortgages are often bundled together and sold as mortgage-backed securities (MBS). The demand for these securities in financial markets also influences rates. If investors buy heavily into MBS, rates can drop. If demand is low, rates climb.

In short: mortgage rates move daily because they’re tied to the same financial markets that influence U.S. bonds.

Your credit score, down payment amount, loan type, and debt-to-income ratio help decide the exact rate you’re offered.

Even a small difference in your rate can make a big impact. For example, a 0.25% change in your interest rate could raise or lower your monthly payment by over $50 — which adds up to thousands of dollars over the life of your loan.

You can’t do much about inflation or the bond market, but you can take steps that directly impact the interest rate you’re offered. These factors are within your control — and even small changes can save you thousands over the life of your loan.

When it comes to your interest rate, credit scores carry a lot of weight. They tell lenders how reliably you’ve managed debt in the past, and that helps predict how likely you are to repay your loan.

There are many types of credit scores out there (VantageScore, educational scores from apps, etc.), but the one most lenders use is the FICO Score. In fact, when you apply for a mortgage, lenders often look at a version of your FICO that’s designed specifically for home loans.

Your score isn’t random — it’s built from five categories:

If you’ve ever checked your score on a free app, you may have noticed it doesn’t match what your lender says. That’s because many apps show VantageScore, which uses a slightly different formula. Lenders don’t use this when approving mortgages, so your “real” FICO may be higher or lower than what you see.

Improving your credit doesn’t have to take years; even small steps now can make a difference before you apply. Here are a few smart moves:

Pay down balances: Aim to keep credit card usage under 30% of your available limit (under 10% is even better)

Avoid new credit: Hold off on opening new accounts or financing big purchases until after closing.

Keep accounts open: Length of credit history matters, so don’t close old credit cards right before applying.

Check your reports: You’re entitled to a free copy of your credit report at AnnualCreditReport.com. Look for errors or outdated info and dispute them if needed.

Stay consistent: Keep paying bills on time, even one missed payment can drag down your score quickly.

So far, we’ve talked about credit scores — one of the biggest factors lenders use to decide your interest rate. But your score isn’t the whole picture. Lenders also want to know: “How much of your monthly income is already going toward other debts?”

That’s where your Debt-to-Income Ratio (DTI) comes in.

Your DTI is the percentage of your gross monthly income (the money you earn each month before taxes) that goes toward debt payments. This includes things like car loans, student loans, credit cards, and your future mortgage payment.

DTI is basically a lender’s way of asking: “If we give you this mortgage, will you realistically be able to pay it back every month?” The lower your DTI, the less risky you look — and the better your chances at getting approved with a strong rate.

If you earn $6,000 per month and your debts total $1,500/month, your DTI is 25%. That’s solid. But if your debts are $3,000/month, your DTI jumps to 50% — which may limit your loan options or lead to a higher rate.

Your DTI works kind of like a balancing act. The more of your paycheck that’s already spoken for by debt, the less room you have for a mortgage. Lenders use benchmarks to figure out if you’re carrying just the right amount — or tipping too far. Different lenders and loan programs have slightly different rules, but here are the general benchmarks:

Here’s a quick breakdown by loan type:

| Loan Type | Ideal Max DTI | Absolute Max DTI |

|---|---|---|

| Conventional | 36% | 50% |

| FHA | 43% | 57% (with factors) |

| VA | 41% | Flexible |

| USDA | 41% | 41% |

👉 Most lenders prefer a back-end DTI of 43% or lower for a standard mortgage. Some programs (like FHA loans) may allow higher DTIs, but it often comes with trade-offs.

If your DTI feels a little high, don’t panic. Most buyers have room to adjust, and even small changes can put you in a stronger spot:

Pay down loans with big monthly payments Knocking out a car loan or credit card balance can drop your ratio quickly.

Hold off on new debt Skip financing new furniture or opening a credit card until after closing.

Put more money down A larger down payment reduces the size of your loan, which lowers your future housing costs.

Boost your income (even temporarily) A raise, bonus, or side hustle can make your ratio look better to lenders.

💡A Tip About DTI: Sometimes it’s smarter to focus on one debt with a high monthly payment instead of spreading payments across several smaller debts. Lenders care more about the monthly total than the overall balance.

Your down payment is the chunk of money you put toward the home at closing. Most people think of it simply as “skin in the game,” but it actually plays a huge role in the type of loan you qualify for, your monthly payment, and the interest rate you’re offered

Like mentioned before, lenders think in terms of risk. The more you put down, the less risk they take on — and the more confident they are in offering you a lower rate. That’s why 20% is often seen as the “magic number.” At that level, your payment is smaller, your rate is typically lower, and you don’t have to pay private mortgage insurance (PMI).

But here’s the thing: 20% isn’t required. Many buyers successfully purchase their first home with much less, sometimes as little as 3–5% down.

When you put down less than 20%, you’ll likely need PMI (Private Mortgage Insurance). It protects the lender and adds to your monthly cost. The upside is that PMI isn’t always permanent. Once you’ve built 20% equity, you can often request to have it removed.

Meet Tim and Lucy. Both are looking at the same $300,000 home, but they’re approaching the down payment differently.

Tim puts down $15,000 (5%). That leaves him with a $285,000 loan. His monthly payment is higher, and he’ll pay PMI until he builds 20% equity. It gets him into the home sooner, but with extra costs each month.

Lucy has saved up $60,000 (20%). Her loan amount is $240,000. That lower balance means a smaller monthly payment, a likely better interest rate, and no PMI at all.

Both Tim and Lucy end up in the same price home — they just structure it differently based on what works best for their finances today.

Great job - you just tackled one of the toughest parts of buying a home: understanding how lenders size up your buying power. You now know the basic of pre-approval, credit, monthly payments, DTI, and the down payment.

Start Next Chapter -or- [ Back to Top ]

Start Your Pre-Approval

In Chapter 3, we’ll walk through the most common loan options (Conventional, FHA, VA, USDA, and more), break down who they’re best for, and share the trade-offs you’ll want to know before choosing one.

You’ve learned how lenders size up your buying power — now it’s time to put that knowledge to work. The type of loan you choose will shape your monthly payment, how much you need for a down payment, and even how competitive your offer looks to sellers.

In this chapter, we’ll break down the most common loan types (Conventional, FHA, VA, USDA, and Jumbo), explain the difference between fixed and adjustable rates, and show how your down payment impacts the overall picture. By the end, you’ll know exactly which options fit your situation — and which ones to avoid.

Before we dive into the different loan types, let’s zoom out. Every mortgage has a few building blocks that shape what it looks like — and what it costs you.

Loan Amount This is the total you borrow from the lender after subtracting your down payment from the home’s price. (If you’re buying a $300,000 home and putting 10% down, your loan amount is $270,000.)

Loan Term The length of time you have to pay the loan back. The most common terms are 30 years and 15 years. A shorter term means higher monthly payments, but you’ll save thousands in interest.

Interest Rate We covered this in Chapter 1: it’s the “fee” you pay to borrow money, expressed as a percentage. Even a small difference in rate can change your monthly payment and how much you pay over time.

Loan Program / Type This is where the differences really kick in. FHA, VA, USDA, Jumbo, and Conventional all come with their own rules about credit, down payment, insurance, and more. We’ll break these down in just a moment.

Down Payment The upfront money you put toward the home. We talked in Chapter 1 about how it lowers risk for the lender and can help you avoid mortgage insurance. Different loan programs have different minimums.

Discount Points Sometimes called “buying down the rate,” these are optional upfront fees you can pay to secure a lower interest rate. One point typically costs 1% of your loan amount.

Together, these pieces make up the “shape” of your loan. Once you understand them, comparing loan types gets a whole lot easier.

Every buyer’s situation is different, and that’s why there’s more than one type of mortgage. The right loan can make buying a home easier, more affordable, or just a better fit for your budget. Here are the main loan types you’ll come across:

Conventional loans are the go-to choice for most buyers. They’re offered by private lenders, usually require at least 3–5% down, and give you more flexibility if you have solid credit and steady income. Put 20% down and you’ll skip private mortgage insurance (PMI) altogether. Most buyers choose a 30-year or 15-year term, depending on whether they want smaller monthly payments or to pay off their home faster.

Credit Score: Typically 620+

Best For: Buyers with solid credit and steady income.

Trade-offs: Stricter requirements compared to government-backed loans

Backed by the Federal Housing Administration, FHA loans are a favorite for first-time buyers who don’t have perfect credit or a big down payment saved. You can qualify with as little as 3.5% down and with lower credit scores than conventional loans typically allow. The main negative is mortgage insurance — FHA loans require it, and unlike conventional PMI, it usually lasts for the life of the loan unless you refinance.

Credit Score: 580+ for 3.5% down (500–579 possible with 10% down)

Best For: Buyers with lower credit scores or limited savings.

Trade-offs: You’ll pay mortgage insurance, and in most cases it stays for the life of the loan unless you refinance.

VA home loans are a top benefit for veterans, active-duty service members, and eligible surviving spouses. They require no down payment, no private mortgage insurance (PMI), and often have lower mortgage interest rates than other loan types. A one-time VA funding fee may apply, though many veterans are exempt.

Credit Score: Often 620+, but some lenders accept lower

Best For: Veterans and service members

Trade-offs: There’s a one-time VA funding fee (waived in some cases)

USDA loans are designed to make homeownership more affordable in rural and certain suburban areas. They require no down payment and come with competitive interest rates, which can make monthly payments much lower than other low-down-payment options.

Credit Score: Usually 640+ (some lenders may allow lower with strong compensating factors)

Best For: Buyers in qualifying rural or suburban areas with modest incomes

Trade-offs: Location and income restrictions can be limiting

Jumbo loans are for homes that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. Because these loans involve larger amounts, lenders require higher credit scores, bigger down payments, and strong overall finances.

Credit Score: Typically 700+

Best For: Higher-priced or luxury homes

Trade-offs: Bigger down payment (often 10–20%), tougher requirements, and more cash reserves needed

At Churchill Mortgage, we offer no score loans for buyers who don’t have a traditional credit score. Instead of relying on credit reports, we review alternative payment history — things like rent, utilities, or other recurring bills. This makes it possible for people who avoid debt to still qualify for a home loan.

Credit Score: No traditional score required

Best For: Buyers who live debt-free or don’t use credit cards/loans

Trade-offs: Requires extra documentation and may come with fewer loan program options compared to conventional financing

| Loan Type | Min. Down Payment | Min. Credit Score | Best For | Watch Out For |

|---|---|---|---|---|

| Conventional | 3–5% (20% to avoid PMI) | 620+ | Buyers with solid credit and steady income | Stricter approval standards |

| FHA | 3.5% (10% if score 500–579) | 580+ (500 with higher down) | Buyers with limited savings or lower scores | Mortgage insurance lasts for life of loan (unless refinanced) |

| VA | 0% | Often 620+ (varies by lender) | Veterans, active-duty, eligible spouses | One-time VA funding fee (can be waived) |

| USDA | 0% | Usually 640+ | Buyers in qualifying rural/suburban areas | Income & location restrictions |

| Jumbo | 10–20%+ | 700+ | High-value or luxury homebuyers | Higher requirements, more cash reserves |

When you take out a mortgage, you’re not just borrowing money — you’re also agreeing on how the “fee” for borrowing (your interest rate) will be structured. That setup determines whether your rate stays the same every month or has the potential to change over time. In other words, it’s about deciding how predictable (or flexible) your payment will be in the years ahead.

With a fixed-rate mortgage, your interest rate stays the same for the entire life of the loan. That means your principal and interest payment never changes, even if market rates rise.

Fixed-Rate Mortgages Are Best For: First-time buyers and anyone who values stability and predictability.

Trade-Offs of a Fixed-Rate Mortgage: The starting rate may be a little higher than an adjustable option.

An ARM starts with a lower “introductory” rate for a set period (like 5, 7, or 10 years). After that, the rate can adjust up or down based on the market.

Adjustable-Rate Mortgages are Best For: Buyers who plan to move, refinance, or pay off their home before the fixed period ends.

Trade-Offs of an Adjustable-Rate Mortgage: Payments can rise after the intro period, which adds risk if you stay in the home long-term.

For many first-time buyers, peace of mind is worth more than chasing the lowest possible starting rate. A fixed mortgage means no surprises in your monthly payment — and that can make budgeting a whole lot easier.

By now, you’ve seen the term PMI or “private mortgage insurance” pop up a few times. Let’s slow down and break it out, because it’s something first-time buyers hear about often, and it can really affect your monthly payment.

Mortgage insurance is an extra cost added to your loan when you don’t meet certain requirements (like putting 20% down on a conventional loan). But here’s the important part: it doesn’t protect you at all — it protects the lender.

By charging you mortgage insurance, the lender reduces their risk in case you stop making payments. In other words, you’re paying an additional fee each month so the lender feels more comfortable approving your loan. That’s why people often see mortgage insurance as “paying more without getting more.”

There are two main types of mortgage insurance you’ll hear about:

Mortgage insurance isn’t forever in every case, but it’s something you need to factor into your budget if you’re putting less than 20% down or using an FHA loan. The key is knowing when it applies, how much it costs, and whether you’ll be able to remove it in the future.

Start Your Pre-Approval

So far, we’ve focused a lot on numbers… pre-approvals, down payments, interest rates, and all the details lenders look at. Now it’s time to switch gears. Buying a home isn’t just about the financing—It’s also about who’s helping you through the process.

That’s where a real estate agent comes in. A good agent is your guide, coach, and advocate. They’ll help you narrow your search, walk you through tours, write and negotiate offers, and handle the details that can make or break a deal.

Find homes that fit your budget and needs

Agents don’t just rely on Zillow or Redfin — they have access to the MLS (Multiple Listing Service), which updates faster and often shows homes before they hit public sites. This means you’ll see more options, and your agent can filter out homes that don’t fit your price range or criteria.

Schedule showings and tours

Instead of you chasing sellers or juggling appointments, your agent handles all the scheduling. They’ll walk through with you and often point out things you might miss, like the age of the roof, signs of water damage, or resale concerns.

Write and negotiate offers

When you’re ready to make an offer, your agent writes up the contract and helps decide on key details: the price, contingencies, and deadlines. They also negotiate with the seller’s agent to strengthen your offer and protect your interests.

Guide you through inspections and appraisals

If the inspector finds issues, your agent helps you decide whether to request repairs, credits, or even walk away. They’ll also keep you informed through the appraisal process, which can affect your loan approval.

Keep the process on track

Buying a home involves lenders, inspectors, title companies, and the seller’s side. Your agent acts as the coordinator, making sure deadlines aren’t missed and that the deal moves smoothly toward closing.

When you decide to work with a buyer’s agent, you’ll usually sign a buyer’s agency agreement (sometimes called ‘the buyer agreement’). This isn’t as intimidating as it sounds. Think of it like setting ground rules. The agreement explains what your agent will do for you, how long they’ll represent you, and how they’ll be compensated. And since no two agreements are exactly alike, it’s worth taking a closer look at the main types you’ll come across.

Touring Agreements

Best for when you’re just testing the waters. A short-term agreement that only covers showings, usually expiring within a week. There’s typically no fee, and it gives you a chance to see if the agent is a good fit.

Exclusive Buyer Agreements

The most common type. You agree to work with one agent who represents only you through the buying process. This creates a clear partnership where your agent is fully committed to your search and negotiations.

Non-Exclusive Agreements

Less common, but useful if you’re looking in more than one market (say, you’re house hunting in two different cities). These agreements let you work with more than one agent at a time, though not every state or agent allows them.

Most real estate agents don’t earn a salary — they work on commission. That means they’re paid a percentage of the home’s final sale price, and the more expensive the home, the higher the commission.

For years, the standard total commission was about 6%, usually split evenly between the buyer’s agent and the seller’s agent. These days, it’s more common to see something closer to 5%, though the exact percentage can vary by region, brokerage, and individual agreement.

It’s also worth noting that brokerages sometimes take a cut of the commission their agents earn. For example, some companies use a “split” setup where a percentage goes back to the brokerage and the rest to the agent.

As mentioned above, agents offer their buyers/sellers market expertise, strong negotiating skills, and access to the MLS (a private database of listings). They’re also the ones scheduling tours, preparing offers, navigating paperwork, and keeping the transaction moving smoothly. In short, that fee covers the behind-the-scenes work that helps you land the right home and avoid costly mistakes.

In some cases, one agent may represent both the buyer and the seller. This is called dual agency. The rules for this vary by state — some states don’t allow it at all.

When dual agency happens, the agent may be earning commission from both sides of the deal. That can open up room for negotiation on commission, but it also means the agent has to carefully balance the interests of both parties. By law and ethics, they’re still required to act fairly, but some buyers prefer having their own dedicated agent to avoid any blurred lines

In March 2024, the National Association of REALTORS® (NAR) reached a major settlement to resolve class-action lawsuits that challenged how commissions were handled in real estate transactions. The lawsuits argued that long-standing rules around commissions—especially requiring sellers to offer compensation to buyer agents—distorted incentives and reduced transparency.

As a buyer, you’ll almost always sign an agreement with your agent that clearly spells out how they’re compensated. Sometimes the seller may still agree to cover your agent’s fee, but not always. That means it’s important to review your agreement carefully and understand what you’ll be responsible for.

✅ Traits to Look For:

🚫 Traits to Watch Out For:

Now that you know what makes a great agent and what to avoid, the next step is finding one. The process doesn’t have to feel overwhelming. With some research, a few smart questions, and referrals from people you trust, you can narrow down the right fit for your needs.

Ask for referrals

Friends, neighbors, or relatives are still the top way most buyers find their agent. If someone you trust had a good experience, ask why they’d recommend that agent.

Do some online research

Look at their website, recent sales, and client reviews. A good website should show their active listings, past experience, and what makes them different.

Check their social media too! Many agents use social media to highlight local knowledge, share market updates, and even show some of their personality. This can help you see if they feel like someone you’d click with.

Interview a few agents

Don’t just go with the first person you meet. Talking to multiple agents helps you compare experience, personalities, and local knowledge. Here are some good questions to ask:

Check credentials

Make sure the agent is licensed in your state and ask if they’ve earned extra certifications or designations.

Look at their track record

How many homes have they helped buyers with recently? How long do their listings stay on the market? These answers tell you how active and effective they are.

Ask about availability

Real estate moves quickly. You want someone who can respond when you need them, not someone who’s stretched too thin.

Review the contract

Before you commit, read through the buyer agreement carefully. Make sure the compensation structure and terms are clear, and that you feel comfortable signing.

We can help! Our Home Loan Specialists partner with trusted local agents nationally every day. Just ask, and we’ll connect you with someone who knows the market and is committed to helping you find the right home.

Start Your Pre-Approval

Buying a home isn’t just about the down payment. At the very end, you’ll also pay closing costs: the one-time fees that make the transfer official. Think of it like the “price of admission” to homeownership. Closing costs usually run 2%–5% of your home’s purchase price. On a $300,000 home, that’s roughly $6,000–$15,000.

For a lot of first-time buyers, closing costs are the single biggest reason homeowning feels out of reach. You may have already pulled together a down payment, and then, right before the finish line, you’re hit with another $6,000–$15,000 in fees.

The good news? There are ways to lower or offset these costs. None of them are “cheating the system.” In fact, many buyers use a mix of these strategies to make closing day more affordable.

Sometimes called seller concessions, this is when the seller agrees to cover part of your closing costs as part of the deal. In competitive markets this is rare, but in slower markets (or if the home has been sitting for a while) sellers may be willing.

💡 Tip: Your real estate agent can help you structure the offer so it’s realistic and appealing to the seller.

Not all lenders charge the same. Application fees, underwriting, origination — these can vary by hundreds or even thousands of dollars.

When you apply, ask for a Loan Estimate (sometimes called a fee worksheet). This is a standardized document lenders are required to give you that breaks down all the costs, side by side. Comparing those estimates is the only way to see the real differences between lenders.

State and local programs often provide grants or loans to help with upfront costs. Depending on your state or city, these programs might give you a grant (money you don’t have to repay) or a forgivable loan that helps cover those upfront expenses.

Some fees, like title insurance, attorney, or inspection, are set by the service provider, not your lender. You’re allowed to shop around. Even a few hundred dollars saved here makes a difference.

Discount points (paying upfront to lower your rate) can save you money over time, but they increase your upfront costs. Make sure they fit your short- and long-term goals before you commit.

Lenders are picky about where your closing money comes from. Here’s the breakdown

You’ve saved, planned, and signed your way through the home buying process — now it’s time for the finish line: closing day. This is when ownership officially transfers and the home becomes yours.

Most closings take about an hour and happen at a title office, attorney’s office, or escrow company (sometimes virtually).

The closing agent goes over your Closing Disclosure — the final breakdown of what you owe and what the seller owes. This includes your down payment, closing costs, and any credits.

Closing costs can’t be paid in cash. You’ll need to bring a cashier’s check or show proof of a wire transfer for the exact amount.

This includes your mortgage note, deed of trust, and other affidavits. Each one basically says: “Yes, I agree to the terms and promise to pay back the loan.”

The seller signs the deed, transferring the home to you. The escrow agent then wires money to the seller.

Once everything is signed and funds are distributed, the new deed is recorded with the county, making you the official homeowner!

💡 Quick Tip: Some lenders now offer hybrid or online closings, which let you e-sign most documents ahead of time. That way, your in-person appointment is faster and less overwhelming.

Once the papers are signed and the keys are in your hand, there are still a few important things headed your way. From official documents to your first mortgage statement, here’s what to expect in the days and weeks right after closing.

This is the final, itemized breakdown of your loan terms, monthly payment, interest rate, and all closing costs. You receive it at least 3 business days before closing, but keep it handy after closing too. It’s your “receipt” for the mortgage and a reference if questions come up later.

You’ll receive copies of your recorded loan documents (like the deed of trust and note). These are mailed after the county officially records them.

These confirm your promise to repay the loan and give the lender a security interest in the property. Hold onto these for your records.

This ensures enough funds are collected in your escrow account to cover property taxes and insurance when they come due.

Arrives within a week of closing and shows your first payment amount and due date.

Expect a welcome email from Churchill’s Loan Servicing department about a week after you receive your first statement, followed by a phone call a month later to answer questions.

We’ll send you a quick survey shortly after closing to learn about your experience.

Once the paperwork is wrapped up, it’s time to shift gears from signing to settling in. Closing day is exciting, but move-in day comes with its own to-do list. A little prep makes it much less stressful.

Here are a few things to cover right away:

📥 First Night Checklist: Here's a First Night Move-In Checklist to help you remember the essentials — from toiletries and chargers to snacks and bedding. Keep it handy so your first night in your new home is smooth.

Start Your Pre-Approval

You’ve closed, picked up the keys, and unpacked your boxes. What happens with your mortgage now? Buying a home isn’t just about getting to closing day. Once the ink is dry, your loan moves into the servicing phase.

The servicing phase is the ongoing management of your mortgage — basically everything that happens month to month until the loan is paid off.

Your loan servicer is the company that:

It is very common for lenders to transfer or “sell” the servicing rights to another company.

Why does this happen? Mortgage lenders often free up money to make more loans by selling servicing rights. It doesn’t mean anything about your financial standing — it’s simply how the industry works.

If your loan is transferred, you’ll get official notices from both your current servicer and your new one. These notices will tell you:

The good news is, almost nothing. Your interest rate, loan amount, monthly payment, payment schedule, and credit history all stay the same. The only thing that changes is where you send your payment, while everything else about your loan remains intact.

💡 Quick Note: Your loan can be transferred more than once over the life of your mortgage. That might sound unsettling, but it’s completely normal.

*The Churchill Certified Home Buyer program is not a commitment to lend funds and is not an approval but is a conditional approval subject to your acceptance of the terms and the conditions being fully satisfied prior to closing. All conditions are subject to final underwriting and final investor approval. The certification is subject to the financial status and credit report(s) of everyone on the application remaining substantially the same until closing, an acceptable contract of sale on a suitable property, collateral (the appraisal, title, survey, condition, and insurance) satisfies the requirements of the lender and loan selected is still available in the market. All closing conditions of the lender must be satisfied including the clear transfer of the title, acceptable and adequate title and hazard insurance, flood certification, and any inspections that are required by the real estate contract.

*Rate Secured is available on 30-year conventional conforming and high-balance fixed-rate loans. Rate Secured is not available on government high balance, construction to permanent, or investment property home loans.

As a responsible lender, Churchill Mortgage is committed to the principles outlined in federal and state lending laws ensuring all potential borrowers have access to the same information, services, and opportunities throughout the home loan process.

As a responsible lender, Churchill Mortgage is committed to the principles outlined in federal and state lending laws

ensuring all potential borrowers have access to the same information, services, and opportunities

throughout the home loan process.

Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender.

Programs are for select loan types only and are not available in all states or locations.

© 2020 All Rights Reserved