We're Proud to Celebrate 32 Years of Service Across the Nation

How We're Different...

We treat customers like family, not a file. By investing in our client relationships and our communities, our goal is to leave people better for the encounter and to guide them with the heart of a teacher.

100% Employee-Owned Company

Leadership Development Culture

Coaching and Mentorship Focus

Meet Michael Brown

Meet Michael Brown, one of America's top producers at over $200 milllion per year , on why Churchill has been his home for over 15 years.

Our ESOP was established by founder and president, Mike Hardwick, in 2013. It gives all current and future Churchill Mortgage employees 100% ownership of the company in the form of company stock. Under the plan, all ESOP participants earn an annual allocation of parent company shares based on their relative percentage of total eligible compensation.

“Employees have a stronger incentive to work hard as well as take greater pride in their contributions to the company. In turn, families and individuals seeking loan products will reap the benefits,” explained Mike Hardwick. The ESOP helps each employee understand how important it is to work together as a team and help our Home Loan Specialists maintain a strong pipeline, close deals fast, and build future business.

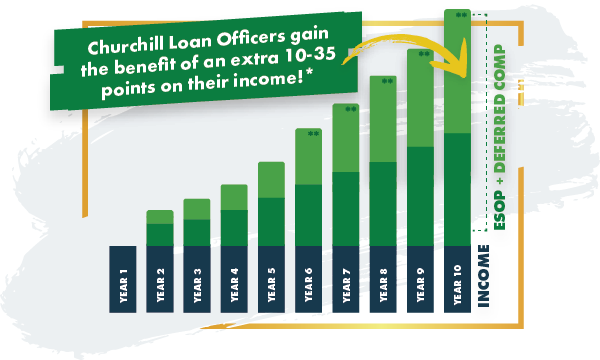

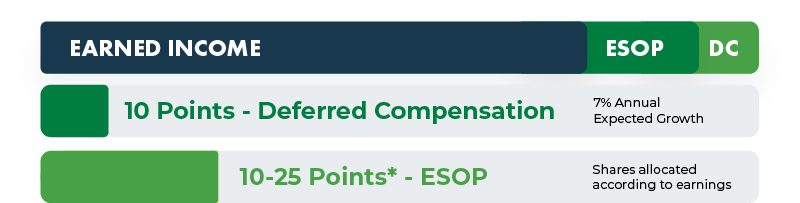

EMPLOYEE-OWNERSHIP PROJECTIONS (ESOP) & DEFERRED COMPENSATION

On average, a Churchill Home Loan Specialist gains the benefit of an additional 20-35 points* on their annual income, thanks to the Employee Stock Ownership Plan and Deferred Compensation.

* This figure is based on historical performance during 2013 - 2021, accounts for accrued annual income, and is not guaranteed income.

** Each Deferred Compensation contribution pays out after a 5-year period. This scenario assumes deferred compensation is reinvested, and displays the total accrued balance of benefits and income.

The benefits of being a 100% employee-owned company like Churchill Mortgage are endless. Here's two we're excited to share.

- Creates a CULTURE where every single employee (owner), understands that the better the loan officer, client, and referral source experiences are... the more business we do as a team. That creates better financial results for the company and for every single employee (owner). The ownership culture that exists at Churchill is the only one of its kind in the entire industry.

- FINANCIAL REWARD for every loan officer. In the graph below, a loan officer who closes $30 million annually has accumulated over $1.2 million in stock/bonus over the past 10 years since the program began. That is a 40% increase over a standard compensation plan throughout the industry.

One of our core convictions is "people over profits."

We've spent the last few decades building a culture where people come first. We've learned that when our people are happy, they provide great service to our clients, and as a result, Churchill Mortgage thrives.

“ I have been in the mortgage and finance business for over 40 years, and have found that it is really a ‘people’ business where there needs to be a relationship of trust. That is what I enjoy most — caring for people. ”

Mike Hardwick, Founder & CEO

As a responsible lender, Churchill Mortgage is committed to the principles outlined in federal and state lending laws

ensuring all potential borrowers have access to the same information, services, and opportunities

throughout the home loan process.

Churchill Mortgage Corporation, NMLS #1591 is an Equal Housing Lender.

Programs are for select loan types only and are not available in all states or locations.

© 2020 All Rights Reserved