Your Home Buying Team Explained

Published: November, 6, 2025| Time to Read: 5 minutes | Word Count: 0

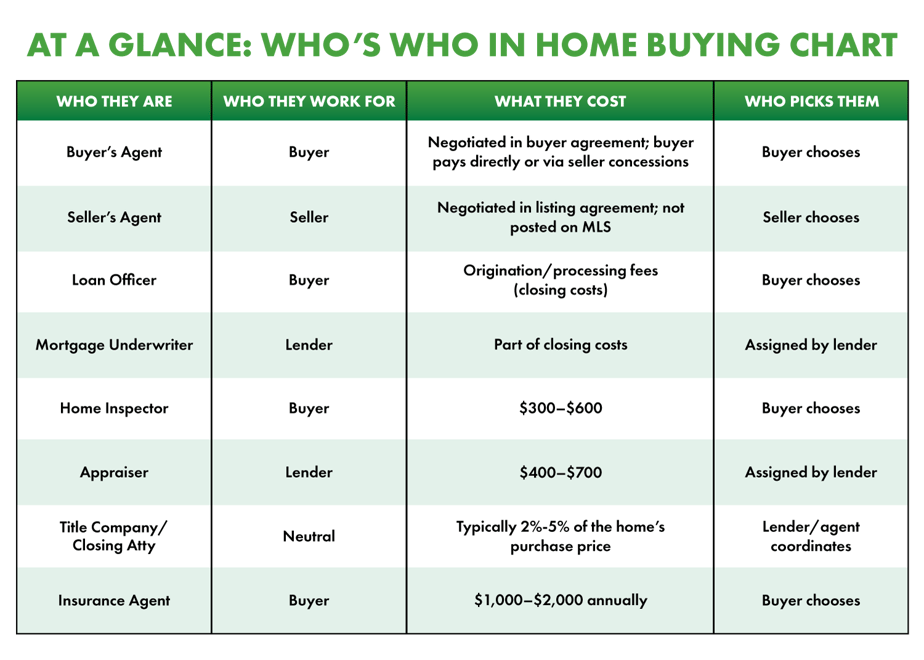

When you’re buying a home, you’ll meet a handful of professionals along the way—some you’ll work closely with, others you may never see but still play a crucial role. Knowing who they are, what they do, and their general fee structure can help you move through the process with more confidence.

Buyer' Agent vs. Seller's Agent

A real estate agent is usually your first guide, but not all agents play the same role:

- A buyer’s agent represents you, helping you search, tour, write offers, and negotiate.

- A seller’s agent (listing agent) represents the seller, marketing the property and securing the best possible deal.

Real Estate Agent Fees After the NAR Settlement (2024):

In 2024, the National Association of Realtors (NAR) reached a settlement that reshaped how commissions work. The old assumption that “the seller pays both agents 5–6%” is gone. Now:

- Commissions are fully negotiable and must be agreed upon in writing.

- Buyers must sign a written buyer representation agreement before touring homes, outlining services and compensation.

- Compensation for buyer’s agents is no longer posted on the MLS. If the seller wants to contribute, it’s handled through seller-paid concessions or negotiated in the purchase contract.

- VA buyers can now legally pay broker fees after a 2024 policy change.

How to find a real estate agent: Referrals are a great place to start, but don’t stop there. Read reviews, interview a few agents, and make sure they clearly explain their agreement (including how they’ll be compensated) before you sign.

What Does a Loan Officer Do in Home Buying?

Your loan officer helps you understand what you can afford, compare loan programs, and guide you through the pre-approval and the mortgage process. At Churchill Mortgage, our focus goes beyond rates—we work to match you with a loan that fits your goals and sets you on the path toward debt-free homeownership.

Loan officer fees: You won’t pay your loan officer directly, but you will see costs like origination, processing, and underwriting fees on your Loan Estimate.

How to find a loan officer: Compare lenders—banks, credit unions, or mortgage companies—and choose someone who takes the time to educate and support you, not just hand over a rate quote.

Looking for a Home Loan Specialist who actually teaches you the process?

At Churchill Mortgage, our experts have the heart of a teacher. We’ll take the time to explain your loan options, what your numbers mean, and how each choice impacts your long-term goals — not just quote you a rate.

What Does a Mortgage Underwriter Do in Home Buying?

The mortgage underwriter is the decision-maker on your loan. They carefully review your income, credit, debts, and assets to ensure you qualify and that the lender is making a safe investment.

Mortgage underwriting fees: These are built into your closing costs and typically listed as “underwriting” or “processing.”

How to find a mortgage underwriter: You won’t choose your underwriter—they work behind the scenes for the lender.

What Does a Home Inspector Do in Home Buying?

Before you finalize your purchase, a home inspector provides a detailed report on a property’s condition. They’ll check everything from the roof to the plumbing to give you a clear picture of what you’re buying.

Home inspection cost: Typically $300–$600, paid directly by you before closing.

How to find a home inspector: Your agent may recommend one, but you’re free to choose. Look for local licensed inspectors with strong reviews.

What Does an Appraiser Do in Home Buying?

While the inspector checks the home’s condition, the appraiser determines value. Their job is to establish the home’s fair market worth, so you and your lender know you aren’t overpaying.

Home appraisal fees: Usually $400–$700, included in your closing costs.

How to find an appraiser: Your lender will order the appraisal from a neutral, licensed appraiser.

What Does a Title Company or Closing Attorney Do?

The title company or closing attorney makes sure the property has a clean title (no ownership disputes or unpaid liens) and oversees the legal transfer of ownership.

Title company fees: Title search, insurance, and closing service fees are included in your closing costs (typically 2%-5% of the home’s purchase price).

How to find a title company: Your lender or agent usually coordinates this, though you can request a provider if you prefer.

What Does an Insurance Agent Do in Home Buying?

Before closing, you’ll need homeowners' insurance in place. An insurance agent helps you compare policies and coverage, so you’re protected from day one.

Homeowners insurance cost: Typically $1,000–$2,000 annually, though this varies based on location and coverage. Most buyers roll it into their monthly mortgage payment.

How to find an insurance agent: Shop around online, ask for referrals, or check if bundling with your current provider saves money.

Bottom Line

From negotiations to home inspections, each professional you meet has a clear purpose in the buying process. The good news? You don’t have to navigate it alone. At Churchill Mortgage, our loan officers are here to guide you step by step, answer your questions, and connect you with trusted local experts so you can feel confident from pre-approval through closing day. Click here to connect with a Home Loan Specialist!

Frequently Asked Questions

Check our FAQs for responses to our most popular questions about your home buying team.

After the 2024 NAR settlement, real estate commissions are now fully negotiable. Buyers typically agree in writing how their agent will be paid—either directly or through seller-paid concessions. A Churchill Mortgage loan officer can help you understand how these costs fit into your overall home-buying budget.

Closing costs usually range from 2% to 5% of the home’s purchase price. They include things like origination, appraisal, title, and insurance fees. Your Churchill Mortgage loan officer will walk you through your Loan Estimate so you know exactly what to expect before closing day.

The inspection is paid upfront (usually $300–$600). The appraisal is typically $400–$700 and is part of your closing costs. Churchill Mortgage can help you plan these expenses and keep your buying process stress-free.

Look for someone who listens, explains your options clearly, and prioritizes your long-term goals. Click here to find a Churchill Mortgage loan officer near you!