The Market Is Shifting: What to Know

Published: September, 29, 2022| Time to Read: 5 minutes | Word Count: 0

As the housing market shifts, it can be a confusing time for both buyers and sellers.

Back in June, Chair of the Federal Reserve, Jerome Powell, made it clear: The housing market would go through a reset. But what does this mean if you're looking to buy or sell a home right now? We're seeing home prices falling and interest rates climbing. And over time, housing inventory is expected to improve.

If You're Thinking About Buying:

If you’re thinking about buying a home today, there’s welcomed news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be coming to a close.

Today, you should have less competition and more negotiating power as a buyer. That’s because the intensity of buyer demand and bidding wars are easing this year. So, if bidding wars were the biggest factor that had you sitting on the sidelines, here are two trends that may be just what you need to re-enter the market.

The Return of Contingencies

Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But now, fewer people are waiving the inspection and appraisal.

The latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving their home inspection and appraisal is declining. And a recent survey from realtor.com confirms more sellers are accepting offers that include these conditions today. According to their August study:

- 95% of sellers reported buyers requested a home inspection

- 67% of sellers negotiated with buyers on repairs as a result of the inspection findings

This goes to show buyers are more able to include these conditions in their offers today and negotiate as needed based on the outcome of the inspection.

Sellers Are More Willing to Help with Closing Costs

Generally, closing costs range between 2% and 5% of the purchase price for the home. Before the pandemic, it was a common negotiation tactic for sellers to cover some of the buyer’s closing costs to sweeten the deal. This didn’t happen as much during the peak buyer frenzy over the past two years.

Today, as the market shifts and demand slows, data from realtor.com suggests this is making a comeback. A recent article shows 32% of sellers paid some or all of their buyer’s closing costs. This may be a negotiation tool you’ll see as you go to purchase a home. Just keep in mind, limits on closing cost credits are set by your lender and can vary by state and loan type. Work closely with your loan advisor to understand how much a seller can contribute to closing costs in your area.

So regardless of the extremely competitive housing market of the past several years, today’s data suggests negotiations are starting to come back on the table. This is good news if you’re planning to enter the housing market!

If You're Thinking About Selling:

If you're worried that you may have missed your chance to sell, here's what you need to know:

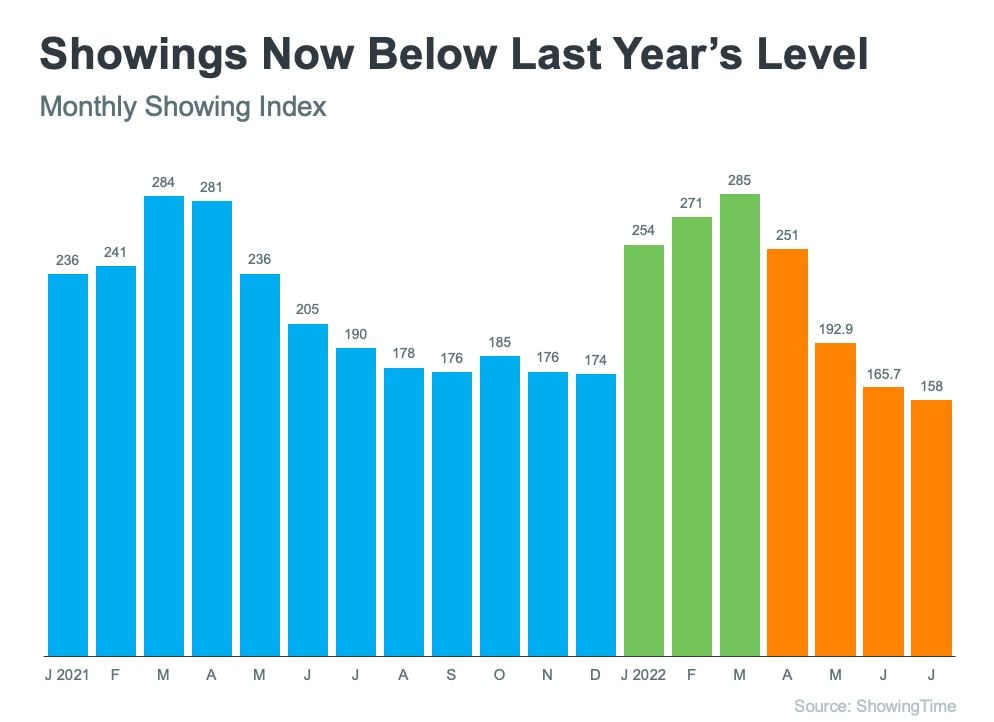

Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the past two years. During the pandemic, mortgage rates hit record lows, and that spurred a significant rise in buyer demand. This year, as rates increased due to factors like rising inflation, buyer demand pulled back or softened as a result. The latest data from ShowingTime confirms this trend.

The orange bars in the graph above represent the last few months of data and the clear cooldown in the volume of home showings the market has seen since mortgage rates started to rise. But context is important. To get the full picture of where today’s demand stands, let’s look at the July data for the past six years below.

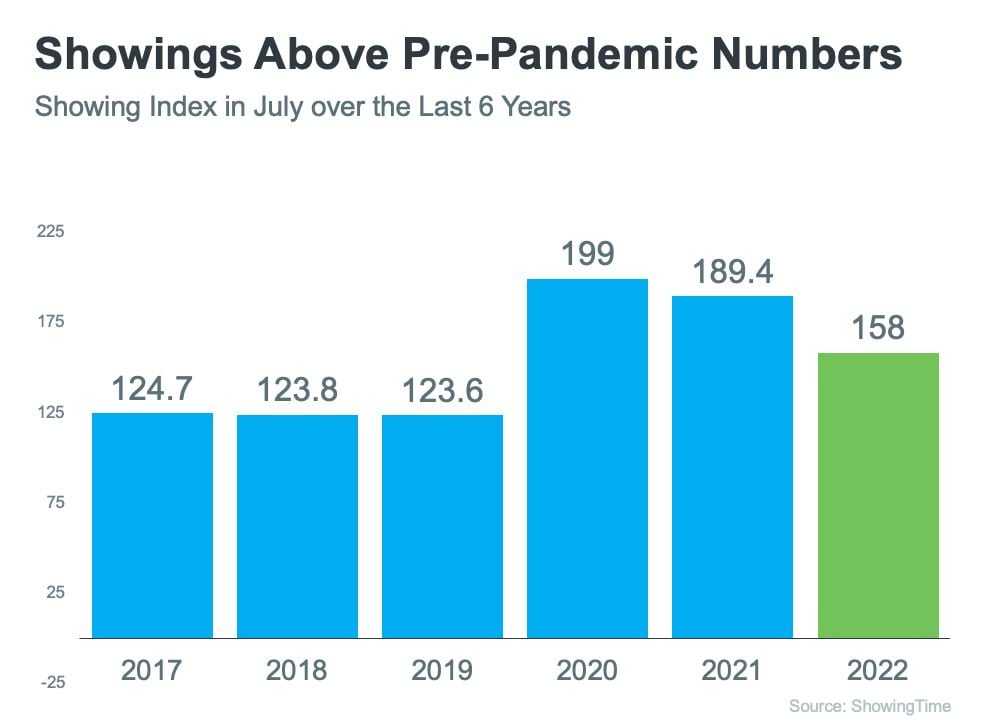

This second visual makes it clear that while moderating compared to the frenzy in 2020 and 2021, showing activity is still beating pre-pandemic levels – and those pre-pandemic years were great years for the housing market. That goes to show there’s still demand if you sell your house today.

The key to selling in a changing market is understanding where the housing market is now. It’s not the same market we had last year or even earlier this year, but that doesn’t mean the opportunity to sell has passed.

While things have cooled a bit, it’s still a sellers’ market. If you work with a trusted local expert to price your house at the current market value, the demand is still there, and it should sell quickly. According to a recent survey from realtor.com, 92% of homeowners who sold in August 2022 reported being satisfied with the outcome of their sale.

Buyer demand hasn’t disappeared, it’s just moderated this year as the market has shifted.

The Bottom Line

So, whether you're looking to buy a house or sell your current home, it's best to work with a home buying team that knows your local market and can help guide you navigate opportunities in your area.

.jpg?height=200&name=iStock-1721571334%20(1).jpg)

-1.jpg?height=200&name=iStock-1479719781%20(1)-1.jpg)