Should You Buy a Home Now ... or Wait Until Next Year?

Published: July, 10, 2020| Time to Read: 5 minutes | Word Count: 0

The subject of renting is always a hot topic, especially now. No one expected a pandemic to come sweeping through and shake up the housing market like it did.

It is smart to look at the whole picture when deciding if you should buy a home now or wait. There is a lot to consider: Both the economy and real estate market come into play, in addition to your personal finances.

Buying Opportunities

As the pandemic continues, it may appear that renting is your best bet. This may be true in the short-term in certain housing markets, but over the next few years you could really miss out on having a house as an investment.

Trying to predict if home prices will rise in your local market is a hard game to play. But we are seeing that in most of the United States, the housing market is continuing to gain momentum. This is great news!

While we are all still trying to figure out what this health crisis means across the country, it is clear the real estate market is in better shape than it was when we experienced in 2008 during the Great Recession.

Rent Is Rising

Rent is rising across the U.S. In many cities, affordability just is not an option anymore. National rents increased 1.4% from last year and it was much worse on the lower-priced end of the housing market.* The jump was worse in places like Phoenix, Seattle, and Las Vegas according to CoreLogic.

In fact, the average millennial will spend $93,000 in rent costs by the time they are 30 years old. **

Other housing markets that are experiencing a large uptick in rents include**:

- Mesa, AZ

- Charlotte, NC

- Atlanta, GA

- Boston, MA

- Orlando, FL

- Louis, MO

- Colorado Springs, CO

- Nashville, TN

- Tampa, FL

- Henderson, NV

- Greensboro, NC

- Austin, TX

- Los Angeles, CA

Your Buying Power

There are many factors that can affect how much you pay for a house, but the main two are:

- Interest Rates

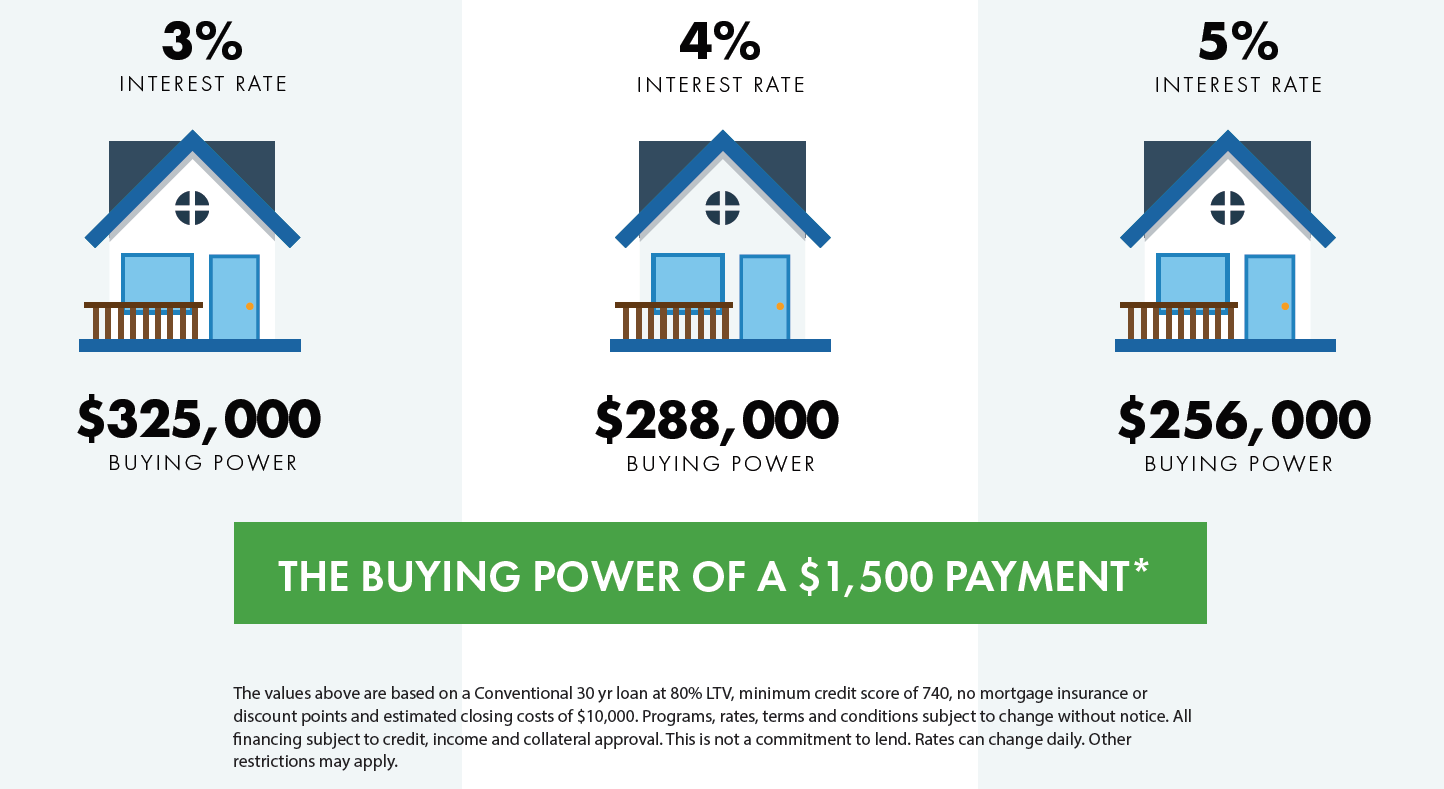

The economic challenges brought on by the COVID-19 pandemic caused interest rates to drop this year (and they were already historically low before we had even heard of the coronavirus). According to analysts, interest rates are expected to remain low throughout 2020. But it is too early to tell what rates will look like in 2021. Mortgage interest rates affect how far your money will go when buying a home. Look at how a 1% change can impact how much home you can buy.

- Home Values

Home values are what buyers are willing to pay in the current real estate market. These values are typically determined by a few things:

- Comparable properties (aka “comps”): This figures in the sales prices of similar homes in the area that have recently sold. It is one of the best indicators of a home’s value. No two comparative market analysis will be the same since every home has different features, but computers now make this easier than ever to compare hundreds of homes at one time.

- Home size: The value of a home is roughly estimated in price per square foot. You take the price of the home and divide it by the total square footage of the home. For example—if the house has 2,500 square feet and is priced at $300,000, you will pay $120 per square foot. That price per square foot helps determine whether the home value is good or bad.

- Location: Appraisers look at three primary indicators when determining value based on location of the house: quality of the local school district, employment opportunities, and how close the house is to shopping, grocery stores, entertainment, etc.

- Upgrades: Updates can add significant value to a home, especially if it is an older home. The key here is to know what upgrades matter the most to home values. A finished basement, hardwood floors, and new roofs are just a few of the updates that help a home’s value.

- Condition and Age: Wear and tear in a home is normal, but if the home is in good condition (or is newer) this usually helps drive up the value.

- Local Housing Market: This is based on the number of buyers and sellers in the market. If there are fewer houses listed for sale, home values could move up (this is called a seller’s market). If they are plenty of houses for sale, but less buyers, home values could go down (this is called a buyer’s market).

- The U.S. Economy: We have all seen the housing market struggle due to economy. Whether it is due to unemployment factors, a recession, or just slow economic conditions in general, home values will fluctuate.

Look at Your Personal Finances

As you are weighing your options of renting versus buying a home, you need to get a clear idea of what the total cost of the home will be. This is important when you are deciding if you should buy now or wait.

If you want to see what a monthly mortgage payment means for your lifestyle, we recommend you give it a try first. Think about your current rent payment. If your new loan payment is going to be higher, put the difference into a savings account on the first of the month to simulate making your new mortgage payment. Once you’ve test driven your estimated mortgage payment, ask yourself if you can make those payments work.

Quick tip: It is also important to think about how much money you would like to put toward your down payment when looking at your personal finances.

Buyer Beware

Many lenders are just trying to get you to sign on the dotted line and want you to overlook what the total cost of the loan will be in the long run. Make sure you understand your out-of-pocket expenses, your financing options, and the total cost of your loan over time before moving forward. Transparency is important!

Timing Matters

Housing markets go through ups and downs, and there is no crystal ball. But timing does matter when you are buying a home. We can help you create an action plan to keep track of interest rates, to update you on what is happening in the market, and to crunch the numbers for you. Even if you are just in the beginning stages, it is important to meet with a Home Loan Specialist right from the start, so you make your mortgage work for you.

-1.jpg?height=200&name=iStock-1479719781%20(1)-1.jpg)

-1.png?height=200&name=how%20to%20build%20home%20header%20image%20(1)-1.png)