This FHA Change Is Huge for Home Buyers

Published: March, 3, 2023| Time to Read: 5 minutes | Word Count: 0

Hey, home buyers! If you’ve been on the fence about buying, recent news from the Department of Housing and Urban Development (HUD) may encourage you to take the leap!

The Annual Mortgage Insurance Premium (MIP) will be reduced on all eligible FHA loans through Churchill Mortgage. This premium went from 0.85% to 0.55% for most borrowers with an FHA loan. This will allow borrowers to save an average of $800 each year!

In 2023 alone, this change could help almost 850,000 borrowers. Here’s the details:

- Applies to single-family homes, condos, and manufactured homes.

- All eligible loan-to-value ratios (LTV) will receive the reduction.

- The reduction also works with all eligible base loan amounts.

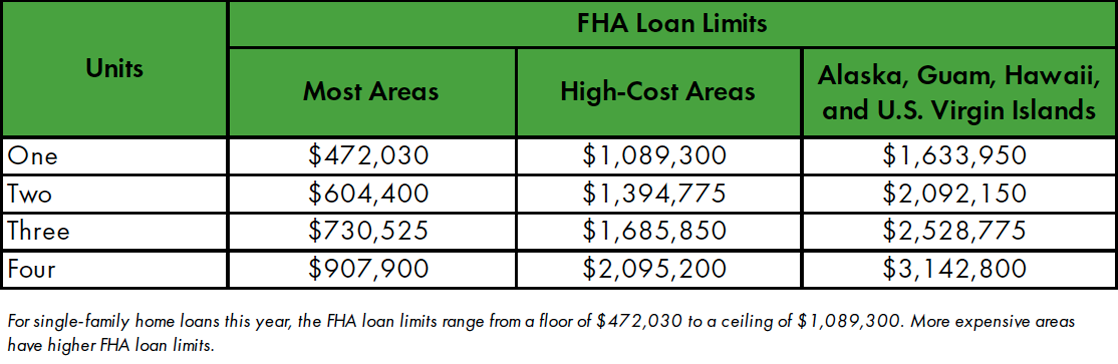

Here’s a look at the base loan amounts for an FHA loan in 2023:

This reduction in MIP is just another reason it may be time to look into homeownership. The money you’ll be saving can go straight toward a mortgage payment.

Owning a home is considered a secure way to build lasting wealth, even in an uncertain economy. Look at it this way…when you pay rent, you’re paying your landlord’s bills. When you own a home, you’re building equity for YOUR future.

FHA Mortgage Facts:

- Requires a down payment of at least 3.5%.

- With a down payment of at least 10%, MIP can be canceled after 11 years.

- A down payment of less than 10% will require MIP for the lifetime of the loan.

- The minimum credit score for an FHA loan is 580 to qualify for the 3.5% down payment.

- A positive rental history of 12 months of on-time payments can be used as part of your mortgage assessment when applying.

We understand that buying a home (especially your first home) is a big decision and an even bigger investment. Your Churchill Mortgage Home Loan Specialist is here to make sure your mortgage is providing for your future, not stealing from your present. In fact, we’re committed to doing what’s right for you.

So, what are you waiting for? We’re here and ready to answer all of your questions! Let’s make you a homeowner!

-1.jpg?height=200&name=iStock-1479719781%20(1)-1.jpg)